alabama delinquent property tax phone number

Revenue Commissioner Kim Hastie. Collecting all Real Estate Property taxes.

Real Estate Property Tax Consultant United Paramount Tax Group

Please select the Schedule an Appointment link or call the appropriate telephone number below to set up an appointment to meet at a service center.

. Below is a listing by county of tax delinquent properties currently in State inventory. NOTICE OF DECLARATION OF THE JEFFERSON COUNTY TAX COLLECTORS OFFICE TO TRANSITION TO TAX LIEN AUCTION. When using a social security number mask the number using the following format.

Select a county below to view the tax properties that will be available at auction this year. You should contact this office at 334-724-2603 for information regarding additional exemption entitlements. Search Tax Delinquent Properties.

Calhoun County Revenue Commissioner. You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State. Drawer 1169 Mobile AL 36633.

UPDATED-Tax Year 2021 Delinquent Taxes. Once you have found a property for which you want to apply select the cs number link to generate an online application. Alabama delinquent property tax phone number.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Business Licenses State County. NOTICE OF SELECTION OF METHOD FOR COLLECTING DELINQUENT PROPERTY TAXES BY TUSCALOOSA COUNTY TAX COLLECTORS OFFICE.

Accurate records must be kept at all times since this office is involved in the. Check back regularly - were loading county lists as they become available so stay tuned. For more detailed standards and requirements please refer to Administrative Rules.

If you have previously received a letter advising that your file has been sent to a taxpayer service center for. Contact Information 251 574 8530. 220 2nd avenue east room 105 oneonta al 35121.

307 Scottsboro Alabama 35768. My Alabama Taxes Contact Search. Cherokee County Revenue Commissioner.

Transcripts of Delinquent Property. Tuscaloosa County Tax Collectors Announces Important Delinquent Property Tax Information. Wilcox County Assessor Phone Number 334 682-4625.

Alabama Delinquent Property Tax Phone Number. Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land. Learn more from the Code of Alabama Chapters 40-2 and 40-7.

Failure to pay Property tax results in a Tax Lien Auction. Taxes are due every october 1 and are delinquent after december 31st. Must be claimed when assessing the property.

Alabama Department of Revenue 50 North Ripley Street Montgomery AL 36104. B You may pay by mail with check or money order to. The median property tax in Wilcox County Alabama is 24600.

Susan Jones Tuscaloosa County Tax Collector Tuscaloosa Alabama has been vested with the sole. To claim homestead Property must be owner occupied Single family dwelling and. 3925 Michael Blvd Suite G Mobile AL 36609.

This section also writes and maintains specifications for property tax administration computer software and provides guidance and assistance to counties acquiring and implementing these systems. Taxes are due October 1. To make payments and view your account online visit My Alabama Taxes.

Ask your mortgage company to pay your bill. Certified checks only after April 2nd. All meetings in the service centers are by appointment only.

Taxes are due every october 1 and are delinquent after december 31st. Partnerships Limited Liability Entities S-Corporations and Fiduciaries. Please call the assessors office in Chatom before you send.

Property Tax Alabama Department Of Revenue. Tax sale lists are updated daily to keep them fresh and to give you a head start on your auction research. Number of parcels per map this number identifies which block on the.

Payment may be made as follows. Assessor Revenue Commissioner and Tax Sales. Tax Delinquent Properties for Sale Search.

1702 Noble Street Ste 104. To contact our office directly please call 205 325-5500 for the Birmingham Office or 205 481-4131 for the Bessemer Division. The 2022 Alabama Auction season is in full swing.

Our purpose is to supervise and control the valuation equalization assessment of property and. Norris REVENUE COMMISSION CLARKE COUNTY ALABAMA CONTACT INFORMATION REVENUE COMMISSIONER OFFICE 114 Court Street Grove Hill ALABAMA 36451 COLLECTIONS. This gives you the ability to pay your property taxes at your convenience anytime day or night.

Hwy 31 S Bay Minette AL 36507. Sales. When contacting Wilcox County about your property taxes make sure that you are contacting the correct office.

Registration for Business Accounts. Search Baldwin County real property and personal property tax and appraisal records by owner name address or parcel number. 256 927-5527 FAX 256 927-5528.

Additional information on property tax exemptions are listed below. Tax Year 2021 Delinquent Taxes. TAXPAYER SERVICE CENTER APPOINTMENT NOTICE.

C Pay property tax online. View How to Read County Transcript Instructions. The transcripts are updated weekly.

260 Cedar Bluff Rd Suite 102. Jeff Arnold Jackson County Revenue Commissioner PO. 334-242-1490 General Info or 1-866-576-6531 Paperless Filing Info Taxpayer Advocacy.

Property Tax sets the standards and procedures for equalization of property values in the counties and ensures property is taxed uniformly throughout the state. October 1 Taxes due January 1 Taxes delinquent February Turned over to Probate 1 Probate. You may come to the Collection Department located at the Calhoun County Administration Building and pay in person.

Baldwin County Revenue Commissioners Office. Mail your payment to the following address. Property taxes are due October 1 and are delinquent after December 31 of each year.

The convenience of paying from your home work or anywhere that you have access to the internet. If you have documents to send you can fax them to the Washington County assessors office at 251-847-3944. Delinquent Property Tax Announcement.

You can call the Washington County Tax Assessors Office for assistance at 251-847-2915. The Tax Collectors Office is responsible for. A You may come to the Revenue Commissioners Office at the courthouse and make payment in person by cash check or money order.

Alabama Department of Revenue. Taxes are delinquent on January 1. And work with the sheriffs office to foreclose on properties with delinquent taxes.

The fee for the Title Application is 1800.

Sell House Before Property Tax Foreclosure Illinois Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

Personal Property Tax Jackson County Mo

Here S How Tennessee S Property Taxes Stack Up Nationwide Nashville Business Journal

Property Tax Alabama Department Of Revenue

Property Tax Alabama Department Of Revenue

![]()

Property Tax Jefferson County Tax Office

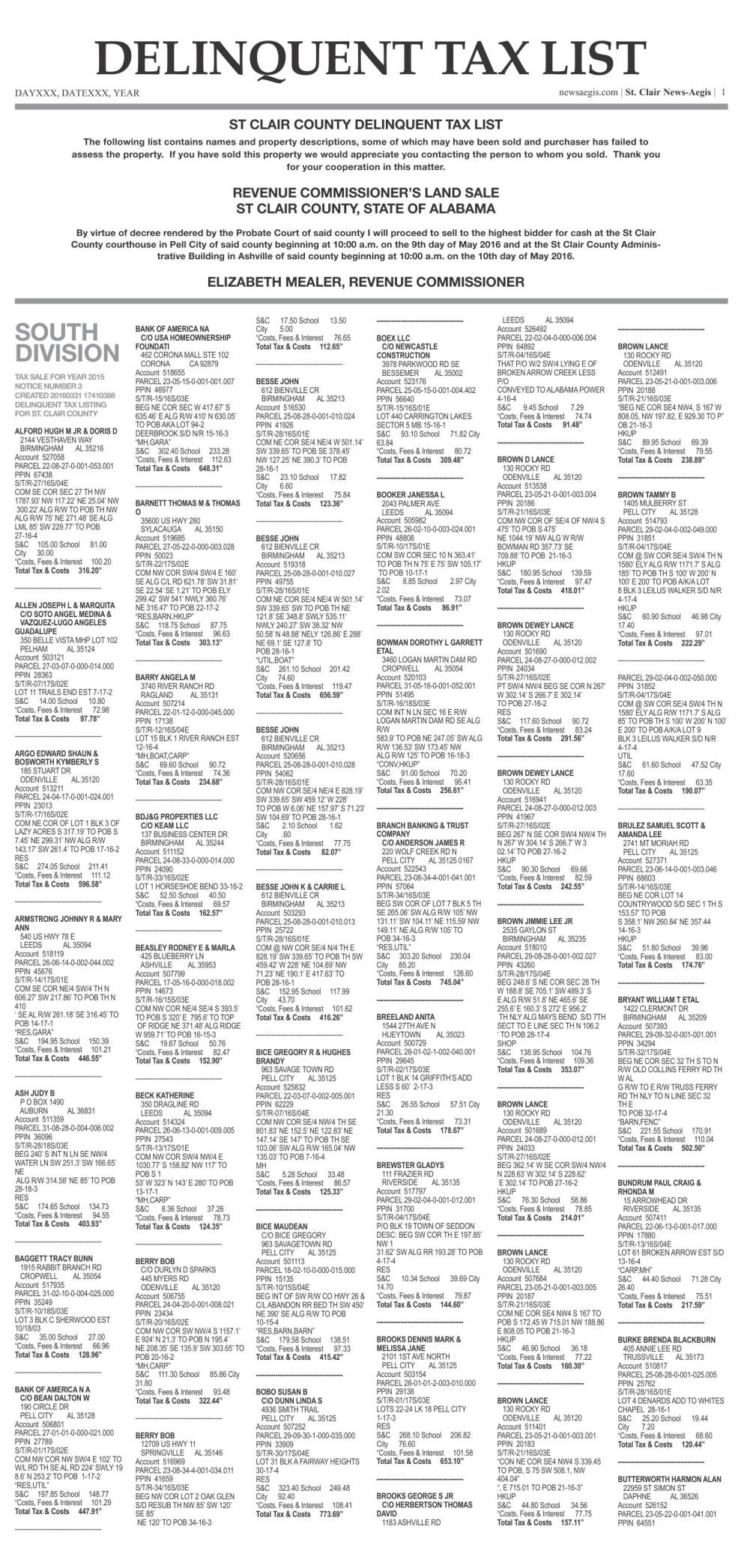

Delinquent Property Tax List St Clair County 2016 Newsaegis Com

Property Tax Calculator Property Tax Guide Rethority

Baldwin County Property Taxes A Comprehensive Guide

Tax Sale Listing Dekalb Tax Commissioner

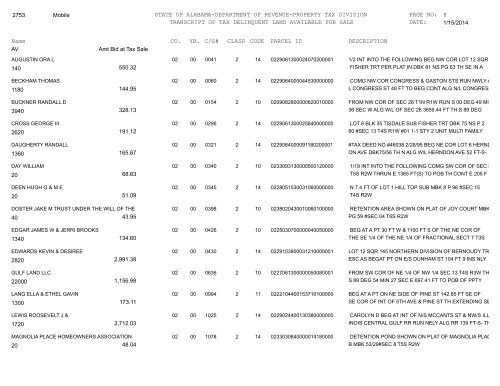

02state Of Alabama Department Of Revenue Property Tax Division

Alabama Tax Delinquent Property Home Facebook

Tax Delinquent Land Sales In Alabama Wholesale Home Buyers Land For Sale Real Estate Buyers Property For Sale

Alabama Property Tax H R Block

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

How To Find Tax Delinquent Properties In Your Area Rethority